financialtreat – will you explain about What Do Financial Advisors Do? which you will get in the following article. let’s look at this article carefully!

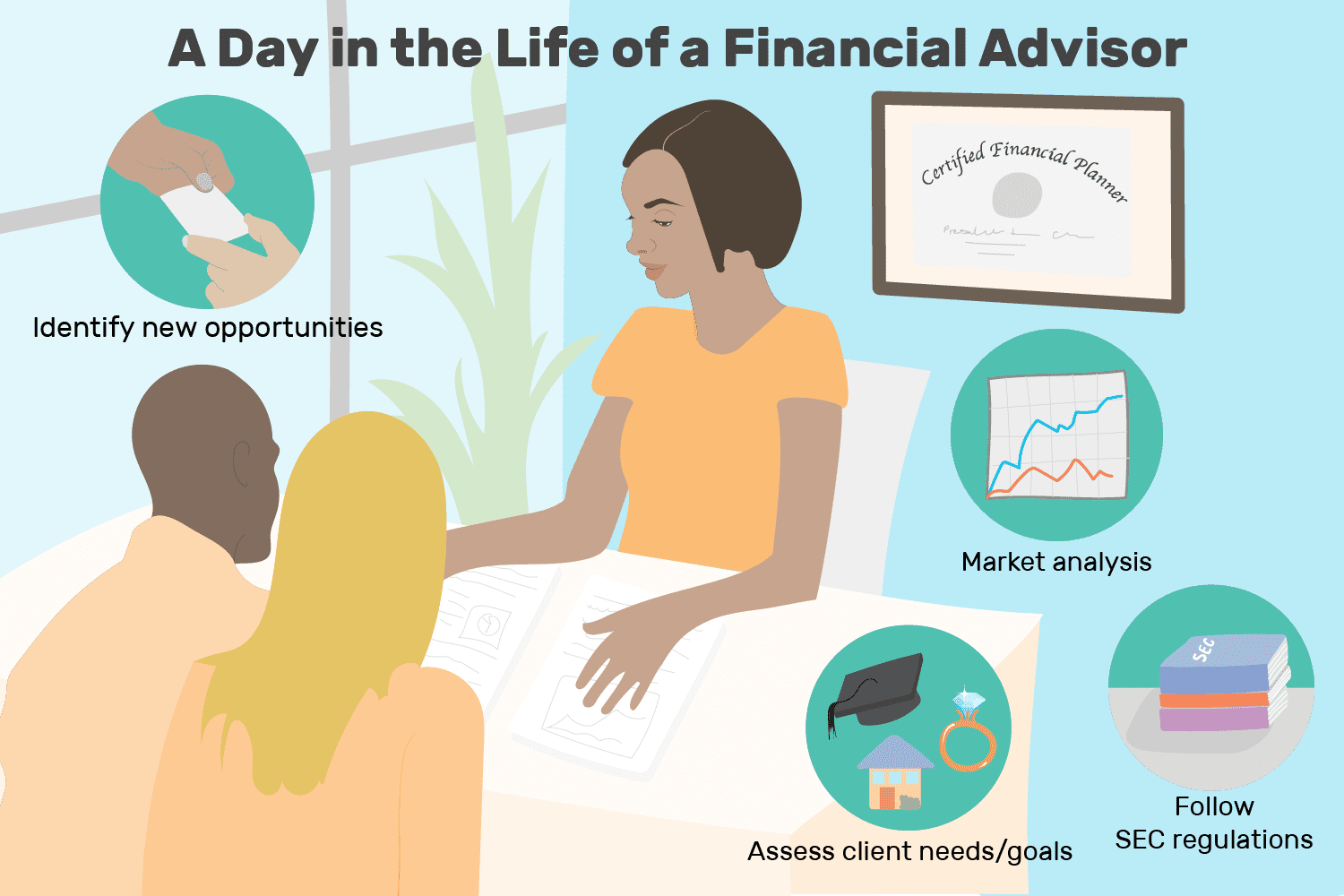

Many wonder what a financial advisor does. In general, these professionals help Adviser you make decisions about what you should do with your money, which may include investments or other courses of action.

The Many Roles of a Financial Advisor

A financial advisor is your financial planning partner. Let’s say you want to retire in 20 years or send your child to a private university in 10 years. To accomplish your goals, you may need a skille professional with the right licenses to help make these plans a reality; this is where a financial advisor comes in.

Together, you and your advisor will cover many topics, including the amount of money you should save, the types of accounts you need, the kinds of insurance you should have (including long-term care, term life, disability, etc.), and estate and tax planning.

The financial advisor is also an educator. Part of the advisor’s task is to help you understand what is involve in meeting your future goals. The education process may include detaile help with financial topics. At the beginning of your relationship, those topics may include budgeting and saving. As you advance in your knowledge, the advisor will assist you in understanding complex investment, insurance, and tax matters.

Step one in the financial advisory process is understanding your financial health. You can’t properly plan for the future without knowing where you stand today. Typically, you will be aske to complete a detaile written questionnaire. Your answers help the advisor understand your situation and make certain you don’t overlook any important information.

The Financial Health Questionnaire

A financial advisor will work with you to get a complete picture of your assets, liabilities, income, and expenses. On the questionnaire, you will also indicate future pensions and income sources, project retirement needs, and describe any long-term financial obligations. In short, you’ll list all current and expecte investments, pensions, gifts, and sources of income.

The investing component of the questionnaire touches upon more subjective topics, such as your risk tolerance and risk capacity. Having an understanding of your risk assists the advisor when it’s time to determine your investment asset allocation. At this point, you’ll also let the advisor know your investment preferences as well.

The initial assessment may also include an examination of other financial management topics, such as insurance issues and your tax situation. The advisor needs to be aware of your current estate plan, as well as other professionals on your planning team, such as accountants and lawyers. Once you and the advisor understand your present financial position and future projections, you’re ready to work together on a plan to meet your life and financial goals.

Creating a Financial Plan

The financial advisor synthesizes all of this initial information into a comprehensive financial plan that will serve as a roadmap for your financial future. It begins with a summary of the key findings from your initial questionnaire and summarizes your current financial situation, including net worth, assets, liabilities, and liquid or working capital.

The financial plan also recaps the goals you and the advisor discusse.

The analysis section of this lengthy document will provide more information about several topics, including your risk tolerance, estate-planning details, family situation, long-term care risk, and other pertinent present and future financial issues.

Basd upon your expectd net worth and future income at retirement, the plan will create simulations of potentially best- and worst-case retirement scenarios, including the scary possibility of outliving your money. In this case, steps can be taken to prevent that outcome. It will look at reasonable withdrawal rates in retirement from your portfolio assets. Additionally, if you are marrie or in a long-term partnership, the plan will consider survivorship issues and financial scenarios for the surviving partner.

After you review the plan with the advisor and adjust it as necessary, you’re ready for action.

Financial advising is a hot topic, and it pays to stay up to date on the Department of Labor’s Fiduciary Rulings, as they may have a significant impact on the financial advising industry.

Financial Advisors and Investments

It’s important for you, as the consumer, to understand what your planner recommends and why. You should not follow an advisor’s recommendations unquestioningly; it’s your money, and you should understand how it’s being deploye. Keep a close eye on the fees you are paying—both to your advisor and for any funds bought for you.

Ask your advisor why they recommend specific investments and whether they are receiving a commission for selling you those investments.

Be alert for possible conflicts of interest.

The advisor will set up an asset allocation that fits both your risk tolerance and risk capacity. The asset allocation is simply a rubric to determine what percentage of your total financial portfolio will be distribute across various asset classes.

A more risk-averse individual will have a greater concentration of government bonds, certificates of deposit (CDs) and money market holdings, while an individual who is more comfortable with risk may decide to take on more stocks, corporate bonds, and perhaps even investment real estate. Your asset allocation will be adjuste for your age and for how long you have before retirement.

Each financial advisory firm is require to make investments in accordance with the law and with its company investment policy when buying and selling financial assets.

A commonality among firms is that financial products are selecte to fit the client’s risk profile. Suppose, for example, a 50-year-old individual who’s already amasse enough net worth for retirement and is predominantly intereste in capital preservation.

They may have a very conservative asset allocation of 45% in stock assets. (which may include individual stocks, mutual funds and/or exchange-trade funds (ETFs)) and 55%. In fixe-income assets such as bonds. Alternatively. A 40-year-old individual with a smaller net worth and a willingness to take on more risk to build up their financial portfolio may opt. For an asset allocation of 70% stock assets, 25% fixe-income assets, and 5% alternative investments.

While taking into account the firm’s investment philosophy, your personal portfolio will also fit your needs. It should be based on how soon you need the money, your investment horizon, and your present and future goals.

Read more financial advisor:

Regular Financial Monitoring

Once your investment plan is in place, you’ll receive regular statements from your advisor updating you on your portfolio. The advisor will also set up regular meetings to review your goals and progress. And to answer any additional questions you may have. Meeting remotely via phone or video chat can help make those contacts happen more often.

In addition to regular, ongoing meetings. It’s important to consult with your financial advisor when you anticipate. A significant change in your life that might impact your financial picture. Such as getting married or divorced, adding a child to your family. Buying or selling a home, changing jobs, or getting a job promotion.$77,329

Thus the article about What Do Financial Advisors Do?. Hopefully it will be useful and thank you.