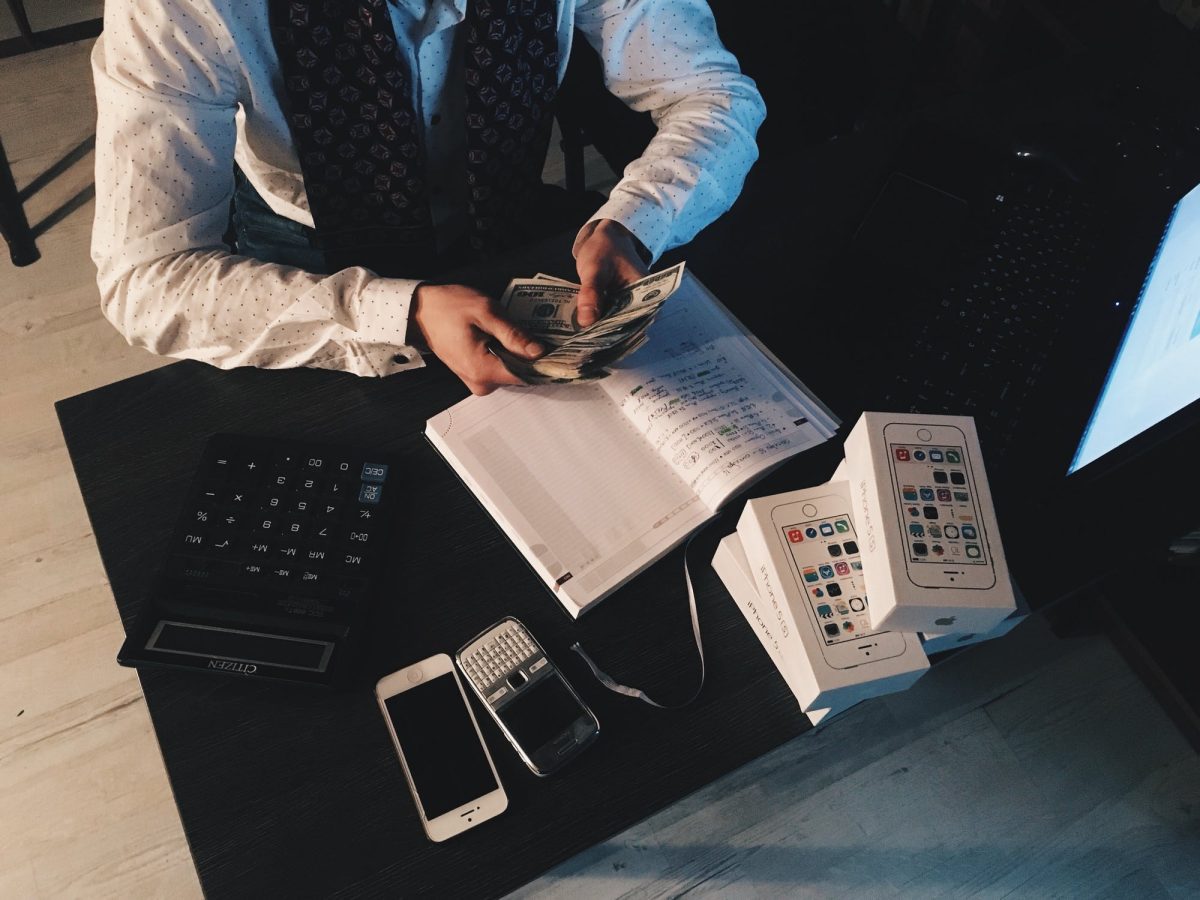

financialtreat – will explain about Private Finance: Definition, Advantages, Disadvantages that you will get in the following article. Let’s look at this article carefully!

Private finance is a term that includes the management of money as well as savings and investments. This includes budgeting, banking, insurance, mortgages, investments, retirement planning, taxes, and plans to own a home or property.

The term private finance also often refers to an entire industry that provides financial consulting services to individuals and households, such as advising on financial and investment opportunities and risks.

Private financial goals are meeting short-term needs, planning retirement, or saving for the preparation of children’s education funds. To be able to achieve financial goals, one must have a mature financial plan taking into account several things, such as income, and expenses.

What is Private Finance (PFI)?

Private Finance (PFI) is a procurement method that uses private sector investment to deliver public sector infrastructure and services in accordance with specifications determined by the public sector.

This method is part of a broader procurement approach called public-private partnership (KPS), with the main defining characteristic being the use of project financing (using debt and private sector equity to provide public services).

Benefits of Private Financial Planning

Allocating Finances

The benefits that can be obtained from private financial planning are to allocate personal finances and businesses that you run. By making a list of financial planning, the company’s finances will be allocated to finance any interests that can have benefits the company line.

Likewise, for personal needs, financial planning can help you to make a priority list of needs. This kind of financial planning will also control any budget posts that are not very important or can be delayed. So that the financial stability of the business and personal is maintained.

Increased Productivity

Private financial planning can be a bridge to increase productivity. The trick is to plan to finance for unspoiled productivity lines that are preceded by meetings or mutual agreements from each party that has authority within the scope of the company.

With the advancement of company productivity, then in the future, this planning will be successful to advance the company to a position that is superior and more advanced than before. Indirectly, with business financial planning you can build a better business future.

Investment

Good private financial planning should include personal life, risk choices, and future goals. It is used to choose the right investment according to your needs, goals, and personality. Financial planning helps you plan and create financial assets for the future.

Achieving Long-Term Goals

Most people have long-term goals in the same life. For example, such as buying a house, buying a car, financing children’s education, and holding weddings for their children when they are adults.

It is undeniable that these goals are very important to achieve. Financial planning helps you devise an accurate plan to achieve your goals within a certain period of time by preparing for all the risks that can be taken to get results closest to long-term goals.

Private Financial Planning Strategy

The sooner you start self-planning, the better, but it’s never too late to make it a financial goal to give you and your family financial security and freedom. Here are the private financial planning strategies you need to know:

Budget Design

A budget is essential to living within your means and saving enough to meet your long-term goals.

Create an Emergency Fund

It’s important to make sure and think about setting aside money for unexpected expenses, such as medical bills, major car repairs, daily expenses if you’re laid off, and much more. The cost of living for three to six months is an ideal safety net.

Financial experts generally recommend setting aside 20% of each salary each month. Once you have filled out your emergency fund, don’t stop. Continue to channel 20% monthly for other financial purposes, such as retirement funds or home advances. So, you must be smart to create an emergency fund if at any time there is something urgent.

Limit Debt

It sounds simple enough so that debt does not get out of control, do not spend more than you earn. Of course, most people do have to borrow from time to time, and sometimes debt can be profitable for example, if it leads to the acquisition of assets.

Use Credit Cards Wisely

Credit cards can be a huge debt trap, but it’s unrealistic not to have them in the contemporary world. In addition, credit cards have applications beyond buying goods. Credit cards are not only important for establishing your credit rating, but also a great way to track expenses, which can be a great budgeting aid.

Maximize Tax Allowance

By maximizing your tax savings, you’ll free up money that can be invested in your past debt reduction, current pleasures, and plans for the future.

Advantages of Private Finance (PFI)

You Can Know Your Financial Position

Managing finances by creating a budget requires you to list all your income and expenses in detail. You can list all your expenses in broader categories such as daily necessities, education, medical, entertainment, to funds for charity.

This way you will know the extent to which your expenses will have an impact on your finances. In fact, whenever you think of adding additional costs you will be referring to the budget, so be able to choose whether you should do it or not.

Helps You adjust expenses

When you set up a monthly budget for a full year, then you will feel that your expenses are quite stable. That means you can make investments. This annual savings capacity allows you to calculate the conditions you can build with the current savings. However, if this condition does not fit the purpose of life, you can rearrange your plan.

You Can Learn About Savings Capacity Limits

When you need to cut expenses to increase your savings, free-spending should be the first target. Budgets help you understand the annual and long-term impact of any adjustments you make with spending adjustments.

If it doesn’t help with enough savings to meet life goals, you should move towards other expenses and look at the scope of other expenses. For example, if you spend money on high rent, you can look for other alternatives to lower your rental costs.

Can Set Realistic Goals

A monthly budget also helps you in checking the scope of maximum savings and the point at which you are not squeezing your expenses. If the maximum savings rate helps you achieve your life goals, then practice budgeting to increase investment.

Disadvantages of Private Finance (PFI)

Must Lead to The Right Portion and Place

In terms of use, management requires to direct finances to the right portion and place. This can certainly be a weakness for fund owners. Because money or funds are restrict, the finances to be allocat must be in accordance with the steps that have been made. The desire to take finances in the desir direction cannot be fulfill.

In addition, restrictions on finances can have an impact on the purchasing power of a person. The finances used will be allocated according to their place. This can result in a decrease in the purchasing power of goods and/or products.

Financial Management Can Manage Finances Themselves

Financial management basically regulates finance itself. The arrangements made to the finances will bring financial direction to a predetermined goal. The management carries out can also have an impact on the process of production for example.

Finances direct at production materials to be purchase will certainly follow the existing financial budget. Because the expenditure is in accordance with management and budget, it is inevitable that the quality of the production materials can be affect. For example, the budget use cannot meet the needs of good quality production materials. Therefore, the quality use switches in accordance with the existing budget.

Do you know about private finance?

So, the conclusion is that private finance is about meeting personal financial goals, whether having enough for short-term financial needs, planning retirement, or saving for your child’s college education.

It all depends on your income, expenses, life needs, and individual goals and desires. You can also create a plan to meet those needs within your financial constraints.

Also read Financial Advisor:

- How Payment Gateway Works Along With Examples, Let’s Check It Out!

- Digital Savings That Offer Many Advantages And Easy Way to Join

To maximize your income and savings, it’s important to be a financially savvy person, so you can tell the difference between good and bad advice for making smart decisions. Thus the article I can make about private finance may be useful, thank you.

5 thoughts on “Private Finance: Definition, Advantages, Disadvantages”